[Guelph, Ontario – January 8, 2024]

Skyline Industrial REIT, a Guelph, Ontario-based Real Estate Investment Trust (REIT) focused on acquiring, managing, and developing modern warehouse and logistics facilities across Canada, is pleased to announce another successful and transformative year.

Economic uncertainty amid the rising interest rate and the inflationary environment through 2023 has posed challenges for many industries, including the real estate sector. However, Skyline Industrial REIT has successfully managed these hurdles, in no small part due to the REIT’s robust and diverse tenant portfolio comprised of both near-term, under-market leases and long-term tenants with built-in rental rate increases. The REIT also credits its selective and opportunistic acquisition strategy, strong development partner relationships, and an influx of capital from the completion of its strategic dispositions for its stable performance throughout the past year.

Key financial metrics in 2023

The REIT has continued to modernize its portfolio with class-A industrial, warehousing, and logistics-focused assets. In 2023, the REIT completed eight transactions, adding three new assets to the portfolio and selling 15 non-core assets (in five separate transactions). In total, the REIT transacted on 1,599,871 square feet with an aggregate gross asset value of $388.68 million in 2023.1

Skyline Industrial REIT’s 2023 Dispositions

- On February 27, 2023, the REIT sold an office building located at 380 Hunt Club Road in Ottawa, Ontario—the last office asset in the REIT’s portfolio—to a local private investor. The total sale price was $4.08 million.

- On February 10, 2023, the REIT sold a single-tenant industrial building located at 500 Saint-Louis Street in Saint-Jean-sur-Richelieu, Quebec. The total sale price was $10.75 million.

- On April 13, 2023, the REIT sold its interest in a 26.17-acre industrial redevelopment site located at 2800 Rue Andre in Dorval, Quebec, out of the Rosefellow Development Fund I. The property was sold for $88.0 million (100% equivalent value).

- On September 1, 2023, the REIT sold 11 properties located in Alberta and Saskatchewan, totaling 364,951 square feet. The properties were sold back to the tenant, Cervus/Brandt Tractor, for $68.0 million, in an off-market transaction.

- On September 13, 2023, the REIT sold a single-tenant industrial freezer storage building located at 7801 Boulevard Henri-Bourassa E, Montreal, Quebec, for $22.6 million.

In total, the REIT completed $193.43 million in dispositions, totaling 716,354 square feet. The majority of the capital raised through these dispositions has been re-deployed into the REIT’s development pipeline and other acquisitions. The REIT’s resultantly strong balance sheet is a testament to the success of this strategy thus far.

Skyline Industrial REIT’s 2023 Acquisitions

- On October 24, 2023, the REIT acquired the unowned interests from its development partner, Rosefellow, and became the sole owner of a recently completed multi-tenant freezer storage and industrial warehouse facility at 3601 Avenue de la Gare, Mascouche, Quebec, totaling 321,008 square feet. A month earlier, in September 2023, the REIT welcomed Congebec as the facility’s primary tenant.

3601 Avenue de la Gare, Mascouche, Quebec - On November 8, 2023, the REIT acquired a newly developed, single-tenant industrial asset at 353 Griffin Way in Woodstock, Ontario, totaling 148,050 square feet. This best-in-class property completed construction in October 2023 and is 100% leased.

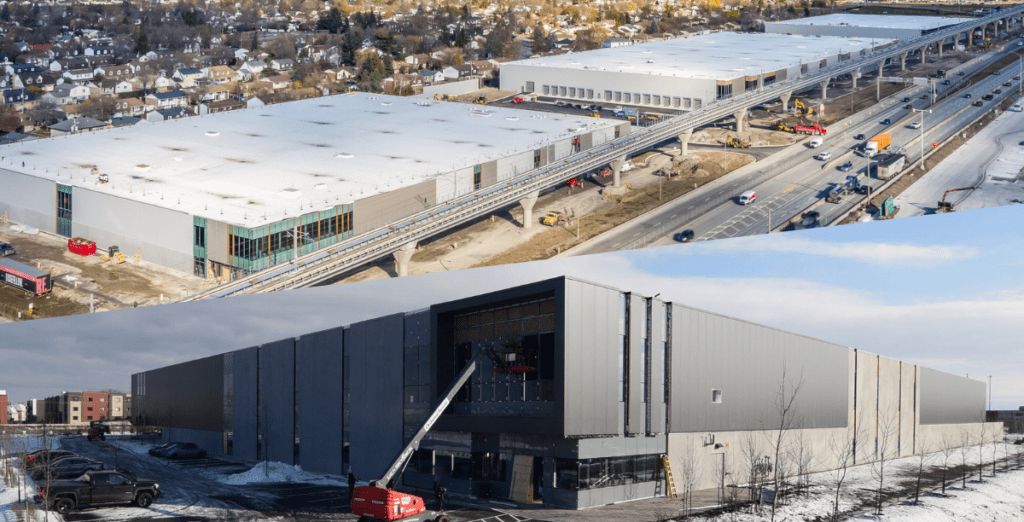

353 Griffin Way in Woodstock, Ontario - On December 21, 2023, the REIT acquired a state-of-the-art multi-tenant logistics warehouse at 1 High Plains Trail in Balzac (Calgary), Alberta, totaling 414,459 square feet.

1 High Plains Trail in Balzac (Calgary), Alberta

In total, the REIT completed $195.25 million in acquisitions in 2023, adding 883,517 square feet of modern A-class space to its portfolio.

As of December 31, 2023, Skyline Industrial REIT is comprised of 50 properties in five provinces across Canada, for a total portfolio size of 9,610,633 square feet of industrial space.

New Development Projects

2023 was a banner year for Skyline’s investment in the Rosefellow Development Funds. The REIT broke ground on two industrial/logistical development projects in Candiac, Quebec. The projects, in partnership with Rosefellow Developments and F.I.T. Ventures, are located at 131 Montcalm Boulevard North and 450 Rue Paul-Gaugion in Candiac, together totaling approximately 619,750 square feet. Upon completion, 131 Montcalm Boulevard North will be carbon-zero certified, and 450 Rue Paul-Gaugion will be LEED-certified. The REIT, Rosefellow, and F.I.T. Ventures also commenced construction on a 296,350 square foot LEED-certified, carbon-zero development in Laval, Quebec, as well as a three-building, 585,401 square foot, Zero Net Carbon development in Kirkland, Quebec.

As a testament to the success of the Rosefellow development partnership, the REIT celebrated the completion of several Montreal development projects in 2023:

- 6100 Rue Notre-Dame Est. Montreal, Q This 98,954 square foot development is now complete, 100% leased, and unowned interest is expected to be acquired by the REIT in Q1 2024

6100 Rue Notre-Dame Est. Montreal, Quebec - 555 & 565 Avenue Victor Davis, Pointe-Claire, Quebec. The REIT welcomed Steve Madden and Dormez-Vous (Sleep Country) to this 274,716 square foot development in October 2023. The building is now 100% leased and unowned interest is expected to be acquired by the REIT in Q1 2024.

555 & 565 Avenue Victor Davis, Pointe-Claire, Quebec - 3601 Avenue de la Gare, Mascouche, Q This 321,008 square foot facility is 90% leased. As mentioned previously, Congebec Inc. occupies the 222,813 square foot freezer storage facility, with 40,000 square feet still available.

The REIT currently has seven development projects in its pipeline in partnership with Rosefellow and F.I.T Ventures.

The REIT was proud to break ground and report substantial progress on its joint venture, Bayers Lake Halifax Development, a 400,688 square foot, two-building, Net Zero Carbon development project on Susie Lake Crescent in Halifax, Nova Scotia.

The REIT has continued to explore opportunities to enhance the value of existing properties through expansion and development opportunities. In November 2023, it completed a 52,000 square-foot expansion for its tenant, TRW, at 6365 Hawthorne Drive in Windsor, Ontario, further strengthening the business relationship with TRW and the overall asset value.

The REIT also announced plans to construct an additional 96,726 square foot industrial building on vacant land within the REIT’s wholly-owned Rampart Business Park in Edmonton, Alberta. Construction is scheduled for completion in Q3 2024.

Together, the REIT’s pipeline of new developments will add approximately 3.1 million square feet of best-in-class industrial space by the end of 2025.

Industry Leadership and Recognition

Skyline Industrial REIT places high value on its relationships with its partners and tenants. In a video released in August 2023 in conjunction with Rosefellow, Mike Bonneveld, President, Skyline Industrial REIT, reflected on the Skyline-Rosefellow partnership’s success and future plans.

The REIT has also positioned itself as a significant entity within the industrial space and has become a key player in many markets. In June 2023, the REIT ranked #8 in Canadian Property Management’s Top 10 Owned and Managed in Canadian Real Estate list, signifying the REIT’s substantial growth and position within the Canadian industrial real estate industry. Additionally, throughout the year, Bonneveld was featured on several podcasts as a guest speaker and was recently interviewed by RENX.ca, discussing the strengths and strategies of the REIT.

With considerations for environmental sustainability continuing to evolve within the industry, Skyline Industrial REIT is not only facilitating LEED and Zero Net Carbon developments but has also started to rollout an EV charging program across its portfolio, with plans for further installations in 2024. As part of Skyline Group of Companies, Skyline Industrial REIT aligns its sustainability initiatives and goals with those of the overarching Skyline entity, in an effort to reduce environmental impact while maintaining and enhancing unitholder value.

Outlook for 2024

Heading into 2024, Skyline Industrial REIT remains grounded in its unwavering commitment to the principles that have defined its success to date. Occupancy rates remain very strong, and a continued growth trajectory is anticipated as the REIT strategically positions itself within key markets. The new year brings a renewed focus on tenant relationships: understanding their evolving needs and fostering REIT-tenant partnerships that extend beyond occupancy agreements.

Central to this philosophy is the proactive approach to tenant renewals and bolstering the longevity of these relationships, as well as bringing rental rates up to market, as the REIT’s leasing principles provide agility in responding to market trends and demands.

Skyline Industrial REIT will continue to focus on acquiring, operating and developing light industrial, logistics, and warehousing assets in primary Canadian cities along major transportation routes and global shipping outlets.

Skyline Industrial REIT is on Fundserv (Code: SKY2012 ). For more information, please contact Invest@SkylineWealth.ca or visit SkylineWealth.ca/Advisory.

1 As of December 31, 2023.

About Skyline Industrial REIT

Skyline Industrial REIT (the “REIT”) is a privately owned and managed portfolio of industrial properties, focused on acquiring warehousing and logistics-centred properties along major highway corridors and transportation routes in Canada.

Skyline Industrial REIT is distributed as an alternative investment product through Skyline Wealth Management Inc. (“Skyline Wealth Management”), the preferred Exempt Market Dealer for the REIT. It is also available on Fundserv (Code: SKY2012).

Skyline Industrial REIT is committed to providing outstanding places to do business and superior service to its tenants, while surfacing value with a goal to deliver stable returns to its investors.

To learn more about Skyline Industrial REIT, please visit SkylineIndustrialREIT.ca.

To learn about additional alternative investment products offered through Skyline Wealth Management, please visit SkylineWealth.ca.

Skyline Industrial REIT is operated and managed by Skyline Group of Companies.

For media inquiries, please contact:

Cindy BeverlyVice President, Marketing & Communications

Skyline Group of Companies

5 Douglas Street, Suite 301

Guelph, Ontario N1H 2S8

cbeverly@skylinegrp.ca